The post Attorney Ron Drescher Speaks With Katherine On “This Needs To Be Said” About Bankruptcy Pros And Cons. appeared first on Baltimore Bankruptcy Lawyer.

]]>

Hello everyone. And thank you so much for joining us on “This Needs to Be Said”. Our attorney friend, Ron Drescher is here with us today, and he’s going to share with us, of course, another topic in the field of bankruptcy. But today we’re going to talk about the pros and cons or the good and bad. What is it going to be Ron? What are we talking about today?

We’re going to talk about the pros and the cons.

Okay, Chapter 13. All right, I see I’m hot on the trail. I can follow instructions. Well, I have my pen and paper out, Ron, and I’m ready to hear, I’m ready to hear this. I was excited about this topic because whenever I hear someone talk about a topic, they is like, they pick a side and you have to go just this way or just that way. So what, what I think you’re going to share with us today is a way for us to make an informed decision. So I’m looking forward to it.

That’s right. So, you know, there are, there are really two main consumer sections of the bankruptcy code that you know, that my clients want to talk about when they come to see me. And those are chapter seven and chapter 13 and chapter seven is great if you can get in and make that work for you. That’s great. The typical chapter seven cases doe’s take about 90 to 100 days. You, you discharge all your credit cards, your personal loans. If you had a car repossessed, if you were fixated from a house, you had a house for clothes, medical debts, all of those kinds of deaths that, that typically get people in trouble. They get wiped out in a chapter seven and you know, nine times out of 10, or even more than that, you walk away with all of the assets that you brought in with you to bankruptcy.

So yeah, chapter seven is great. If you can do it, some people just can’t do chapter seven for a number of reasons. Maybe they filed it, you know, within the last eight years or their income is too high or they have too much equity in their assets so those are reasons why they can’t file for chapter seven. And then there are other things where you can only get benefits by chapter 13. For example, if you wanted discharge toll violations or parking tickets, or if you want to cure an arrear on your home mortgage, or if you want to, you know, pay down the value of your car over, over 60 months, those are the things you can only do in chapter 13. So for people in that situation, chapter 13 is wonderful. It’s great that you have the ability to, for example, cure your rears over 60 months, in the event that your lender doesn’t give a loan modification, or let’s say you’re paying 24% on your car. You can go into bankruptcy and get it down to 5%, which is pretty miraculous. So though, that’s one of the reasons why chapter 13 is so wonderful because it really allows you to do some pretty miraculous things.

Do I chapter Right? Doesn’t that sound great?

It does. Yeah. All I heard while you were talking was keep the stuff that you had when you went to bankruptcy. So I was like, yeah, all of this sounds great, you know, but there are pros and cons of that as we’re talking. So that sounds really good. So, what’s the, what’s the bad side. Well,

After 13 you’re required to pay over all of your net disposable income over the life of your plan, which is, you know, 36 months to 60 months. And for had the bankruptcy trustee, the chapter 13 trustee is going to take a preliminary look at your monthly income and expenses. And if that trustee says, you know, what this particular expense I don’t think is reasonable then you’re going to have to have a fight and see if the judge agrees with you. The judge almost always agrees with the chapter 13 trustee, almost always. So, you know, if you, if you’re a high income person and we have a lot of them that get into trouble financially, and you’re used to making certain payments, you know, your kid’s private school, maybe mortgage on a second home, you know, maybe, you know, different household expenses, then, then you’re going to have a lot of trouble because you’re going to have to let go of some of those expenses and pay that over to creditors. Like I’ve got, I’ve got clients who have children who are in college and generally, and they’re paying their children’s, you know, living expenses. You’re not allowed to do that. And in chapter 13, and that’s a real, that’s a real hardship. Those are those, you know, your child is over 18, they’re considered an adult. You’re not allowed to, in the absence of extraordinary circumstances, you’re not allowed to pay their expenses while they’re in town.

I don’t know. That might be a good thing. That might be a good cause. You know, if parents have a hard time saying no to their children, they can put it on the, you know, the attorney, listen, I can’t bake. So some parents are looking for a way to say no, that might actually be a good thing. I don’t know.

I don’t think you’re wrong about that, but it, but it does as a real shock to my client, it is a shock, you know and so they say, wow, you know what I, you know, look high. Some people are, are often used to going out for a meal or, you know, going on, you know, expensive vacations or, or doing these things. And you could still go out to a restaurant. You could still take a vacation but you know your expenses there, they’re going to be looked at by the trustee and potentially by the court. So that’s hard. It’s very hard to dedicate all your net disposable income for five years.

Yeah. Yeah. Yeah. The part about the kids, I think, and, and I’m at the age where I have adult children and I have friends with adult children. And the expectation is that, you know, we are an ATM for the children. Well, I’m real good at saying no. Anyway, I say no. Before I even hear what the request is, what is it And then, you know, we kind of know we’re working our way out of a note, but more than likely it’s no, but my friends, I was like, Oh my why, why are you stressing over that Why can’t you just tell your child No, and I, they don’t have a good reason. And I think you’ve just given like a good reason, you know, it’s on you to reset their life. Listen, you know, mom’s trying to get back on track and, and it’s not a lie, but it’s your way out because some adults don’t know how to say no to their adult children. So I don’t know. I think that can go on the pro list.

Sure. And that’s, and you know, and that’s a big deal cause that comes up a lot. you know, so, you know, another thing is, you know, if you have equity in your property, that now if you have sufficient equity in your property that could even drive your payments above your debt, disposable income right. And so that can be a real problem. Sometimes I’ve got clients who have just too much equity in their property. So they ended up having to pay all of their creditors in full. and, and that’s a hardship for them to they, then what they have to do is they’ve really got to cut back on even normal, monthly expenses for that period of time so that they can become debt free. That’s, that’s a hard thing for them to,

But the thing really is that bankruptcy is a privileged, just the right. Or is it a difference between a privilege and a right, right.

This sure is in bankruptcy privilege and it’s not a right. Okay.

So it’s a privilege that we get to reset ourselves. So it is hard to even be in the space to face. I have to reset myself and I can imagine the rest of the shocks that other people feel going through bankruptcy. I’ve gone through one and I didn’t have an attorney like yourself, so it was, I mean, the person was nice and they did, they did, they did their job, get my tongue together, but it was still, it was hard. It was hard to do. It was hard to go through that. It was hard to feel everything that I was feeling and, and make a decision about what I must do to get back on track. So I get all of that is a shot, but the fact that we have the opportunity to reset ourselves, I think is the big outcome. And that’s what you talk about. You know, we get through the emotional part of it or the shame on me, part of it. And now we can really see the bright side and reset ourselves. And you’ve also talked about the good of coming out of bankruptcy that we could come out better than we were before we went in. So

Yeah, that happens a lot, you know, for the people who can, find the discipline to make it work. Those people are going to be in great shape at the end of their chapter 13 plan because they’ll have established great habits and they can, they can start a pattern of savings wishes, which is really where you want to go. The, to me, the whole point of bankruptcy is not just to solve one problem, but to, but to create a lifestyle where you can, where you can build financial security.

Yeah. Yeah. It’s hard. It’s hard. I’m just, I’m thinking about it. I’m like, yeah, it was hard for me. And that was many years ago. And I, I just imagined, cause even now when I can’t do something because of something else that has to be done, even if it’s a little thing, like I can’t go get coffee or I can’t go to the store as opposed to I’m doing what I need to do. It’s just that thought that I can’t do it as opposed to it’s an option. And we can really, you know, it, realigns your thinking and bankruptcy reset will shake you up. So I think if you have to practice something for five years, you’ll definitely have a good, good habit. Sure. You have a good one. That’s definitely

That’s, that’s actually right. And you know, during the time of you’re in a chapter 13, if you want to buy or sell a car or you want to buy or sell a house or do anything like that you’ve got to get bankruptcy court permission to do it and that is a hardship for people who are used to just kind of managing their affairs as they please, as adult citizens in the world. No, while you’re in bankruptcy, chapter 13, you have to get permission from the court. A lot of times clients don’t like that. The chapter 13 world prefers that you have wage orders in place so that when you file the chapter 13, instead of voluntarily making that monthly payment to the trustee, the trustee has it deducted from your pay on a, you know, weekly, biweekly, monthly basis, which is the cases that have, that have a much higher degree of success.

Then when the clients meet to write the check because that’s a painful check to write nowadays it’s a little easier because most trustees have enacted a, a system where they can automatically debit the money from the bank account and they, and they just set that up to, you know, they set it and forget it. And that’s great thing too. That’s almost as good as the wage garnishment, but people, they, they want to know that they’ve got that ability to manage their finances, in the case of an emergency and I totally understand that, but it does increase the likelihood that your case won’t succeed.

So these are I’ve been talking about the pros and the cons. The pros are, of course, at the end of the five years, you’re going to get a discharge of your debt. You’re going to be more or less debt-free unless you have, you know, student loans and you know, and you’re, you’re in great shape at the end of those five years. That’s, that’s the reward, but the price of, of paying over that net disposable income every month and being under the, under the scrutiny of the bankruptcy world for those five years, that is a hard road for a lot of people.

It is, it is. Cause it’s something that we, we haven’t done. We say the word budget, but it’s not really that budget is what I have until I don’t have it in a, in a sense as opposed to really setting things aside for rainy days, sometimes quotes don’t really do what they’re supposed to do. Cause what is rainy day, if you don’t have a purpose for it. And so people miss the point of it until we do find ourselves having to sit with you, and it’s a new way of thinking. It feels like punishment until it’s not. So I mean, you absolutely, right. This is great. I’ve enjoyed it as always. I enjoy when you come on now, are you working on any new programs Do you have a book coming out What’s going on What else do you have coming out

You know, I actually, where we’re at an end of the summer period, you know, I’m still selling my course, called complete bankruptcy for attorneys that want to get into the bankruptcy world. and I, you know, I wrote a book, a single mom’s guide to, financial recovery and I’m probably going to start, you know, accelerating, sending that out to the moms out there who are probably struggling with this whole COVID mess.

Awesome. Awesome. Awesome. Well, how do people get in touch with you outside of this interview

The best way is to go to the website, www dot Drescher law.com. That’s D R E S C H E R L a w. From there you can schedule an appointment, you could do a chat, you can check out what we’re working on and you could even make a call to the office.

Fantastic! Until our next time have a super day. Ron. Thanks a lot.

I really enjoyed it.

The post Attorney Ron Drescher Speaks With Katherine On “This Needs To Be Said” About Bankruptcy Pros And Cons. appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Attorney Ron Drescher Speaks With Katherine On “This Needs To Be Said” About A Course Called, COMPLETE BANKRUPTCY. appeared first on Baltimore Bankruptcy Lawyer.

]]>

Hello, everyone. Thank you so much for joining us on “This needs to be said”. Our friend, attorney, Ron Drescher is here with us again today. And he’s going to talk about a course that he’s doing called complete bankruptcy. So for my attorney, this is something for you to tune your ears up to. And even for us who are friends of attorneys or get our antenna going cause, I’ve learned so much every time I talk with you, attorney Drescher. So I’m going to learn in that point, someone in the right direction. I appreciate it. How have you been?

You know what I’ve been, I’ve been very, very busy because I, yeah, cause you know, right after the shutdown started, sometime in early April, I started getting calls from other lawyers who were interested in getting into the bankruptcy field because they said, wow, you know what The economy is going to go through some really hard times. And you know people are going to need help. And I think it would be really great to transition and be able to take a few bankruptcy cases here and there because that’s going to be a hot practice area. Do you know of any resources and I really didn’t. and so I thought, you know, I’m going to create this course and I’m going to offer it to the lawyers so that I can help train the new lawyers that are coming into the practice, how to do it, right? So that clients get taken care of. And so the attorneys can, you know, benefit from that increase in business. And that’s what I’ve set out to do.

I have a question. So these attorneys that were reaching out to you were not previously bankruptcy attorneys, is that what you’re saying?

Exactly! Exactly!

Oh, how simple. Cause I went to school for education so we can make what’s called a lateral move if you have a degree in anything but education to get into the teaching profession. So I don’t know if that’s similar with attorneys. How would one convert because they saw an opportunity, but how simple is that to change?

I don’t think it’s simple. I don’t think it’s easy, but I think that it’s possible if I have a mentor that is guiding you in the right direction and helping you separate, what’s really important for you to know versus the things that, that are less important for you to know so that you can accelerate your entree into that field. So, the course is primarily videos cause you know, I have 250 YouTube videos about different aspects of bankruptcy law. So I’m very comfortable delivering information in that format. So I do videos and there are three main modules. There’s what I call a client solutions module, which is the kind of things that you should expect to see. Then there’s the basic approach, which is how you take your case from the first, meeting with the client all the way through to the close of the bankruptcy case.

And then I have a chapter 13 module. Now these courses are really designed to be pragmatic so that you can hear them or, you know, or look at them. I set them up as videos, of course, and the videos have, have like bullet points on them or emphasis points on them. Cause there are certain areas that I really want the lawyers to pay attention to and to focus on. I also rip off MP3s so that they can download them to a device and listen to them while they’re driving around their cars. And I also have them all transcribed. So, and then I have forms. I talk about systems and workflows. I talked about marketing issues. I talk about things that are very specific to how to fill out the bankruptcy forms. What I call top five. I mean, you know, to fill out a bankruptcy form is not complex, but to, to have the benefit of seeing a few different ways that you could either get into trouble if you don’t fill them out correctly or to deal with situations that come up, but are not, you know, plain vanilla.

I do what I call the top five series. So top five for each of the different bankruptcy forms and I just started, pre-selling the chapter 11 small business module. That’s going to be released August 10th. And right now I’ve got, I have over 50 lawyers have signed up for the program. How long will it take them to complete the program It’s a program it’s a, it’s a teach yourself. I would say to go through all of the materials, if you weren’t doing anything else, you were really studying and focusing on, it would take you about a week if you just went through everything but like I said, there’s a mentorship component. I’ve created what I call the complete bankruptcy mastermind. And that is a twice monthly zoom, meeting where, I, the lawyers convene and I go into a deep dive on some area of interest to the lawyers and then the rest of the time is open for Q and a.

So they have a chance to ask me questions specific to that topic or their practice or a case they’re working on or bankruptcy law in general or how their law firm is working. Plus while you’re in the mastermind, you can, send me emails and I will respond within 24 hours and I have lawyers sending me emails all the time. I’m happy to answer them. And, and two months of the mastermind come with the course. And then after that, that way, I guarantee that they will have the opportunity, not just to have the information on video and audio, but also to help flesh out issues that come up because, you know, you’re a lawyer entering into a new practice area. You want to be able to have somebody to bounce thoughts off and you know, and listen, I’ve, I’ve had people call me, or send me emails before on issues and they, you know, you feel embarrassed after a certain point that you go to the well too often but if, if you have somebody who is saying, listen, I’m going to be your mentor. You know, don’t hesitate to send me these emails. You’re a little bit more relaxed in sending those emails. You’re more likely to accelerate your learning.

Absolutely, well, I’m excited because you said something else that has nothing to do with the attorneys, but my business ears perked up. Can you tell me a little bit about the course that starting in August you said for small businesses?

Yes. Well, it’s not for small, but it’s for lawyers.

I bet I could learn something from it though, right.

Absolutely good! It’s for lawyers to handle small business and chapter 11 cases. She knows it’s very interesting. A new bankruptcy law was passed that went into effect February 20th of this year. That makes it easier for small businesses to go through chapter 11. It doesn’t make it easy. It makes it easier. And that’s an important distinction but, and you were required to file your for your plan of reorganization within 90 days. Well, the country went on shutdown, in the middle of March and all of these timeframes were extended. So I don’t know if more than a tiny handful of, of these small business plans have even been filed. so, lawyers that want to get in on the small business chapter 11 practice, which can be very profitable caveat, you can also lose your shirt, can get in on the ground floor and kind of have, have equal footing with, with experienced bankruptcy lawyers, because nobody has been working through the new law and now is the time to get involved and really, have an opportunity to get, make progress in your bankruptcy practice.

Now, there is something that I’ve noticed with you whenever we talk you’re you find a segment in bankruptcy and you focused on it because you did one for the single mom and we talked about that a while ago, but you find now this opportunity to be the educator of the attorneys and that you’re always educating. This is my point. And the fact that you have the complete bankruptcy course, the mentorship, as well as the small business piece for them and showing them how to seize the opportunities to really get the most for their clients as they’re helping them. So I always commend you for educating and for really having that eye for what’s being overlooked because years ago, when I filed bankruptcy, there wasn’t someone like you letting me know as a single mother it’s okay. You know, and he’s going to be able to reset yourself. And so now you’re telling the bankruptcy attorneys, Hey, well, the new the com the ones that are going to come over to become bankruptcy attorneys, this is an opportunity, and I’m willing to help you and take a lot of the I should know this stuff when we really shouldn’t, out of it for them, you take the scary part out for them. So thank you.

Well, that’s so nice of you to say, by the way, there’s there, I speak to that very issue you just raised, which is that there wasn’t a lawyer there to, to say that it was okay to file. And one of the points that I emphasized to the lawyers in the client solutions module is that it’s important for the lawyer to somewhat be a bit of a cheerleader for their clients, because, you know, it’s one thing to know how to fill out a form and to file a bankruptcy gaze and to get a discharge but you know, there are feelings of failure that clients go through when they filed bankruptcy and I think the really skilled bankruptcy lawyer understands that and addresses that on an emotional level with the clients and one of the things that I say to clients and that I, that I tell the lawyers and I advise them to say is most really go through extraordinary lengths to avoid bankruptcy.

They’re not running up credit cards and then jumping in there being all abusive. That’s not, I mean, you’re talking about the tiniest less than 1% of bankruptcy. Clients are like that. Most people struggle and they work really hard to pay their deaths. and what I tell people is, you know, people who are going to be clients is that, look, when you take on a debt, you have a plan to pay that debt back. And it’s a plan that you’re putting together in your mind in good faith. And bankruptcy happens when the plan goes awry, usually through no fault of your own, or even if it is your fault. It’s, it’s a, it’s just mistakes. It’s not, it’s not,

You didn’t set out to do it, right.

I’m set out to take advantage. And so I commend my clients for their heroic actions. I say, you know what I could see you really took your ROIC steps to avoid this. So I have a lot of respect for you and you know what that’s important for the client to hear. And, and it helps bonds the attorney with the client and it really meaningful way.

Yeah. I need to trust you. I’m scared right now, life has changed. I remember that feeling. We have to wrap up because our time is up. Tell people how to get in touch with you. If they want to know more about what you’re doing. Cause there will be some attorney that is going to hear this or read this blog and need what you have. We never know where that student is for you. So make sure you give them that information.

Well, definitely go to my main website, www.Drescherlaw.com that’s D R E S C H E R L A W. I’m going to have a form that you could fill out and a link to a, to a page where you can get a little bit more information about the course and you could also go to complete bankruptcy.law, and that will also take you. So either Drescherlaw.com or complete bankruptcy.law will get you to where you need to be. So you can get some more information and, and then that’ll put you into a campaign which I will teach you how to do that will give you all the information to give you a lot of freebies or things you can download. That’ll give you some idea of, of, of what it looks like to be a bankruptcy lawyer,

Ron, until next time; have a super day.

Thanks a lot, Katherine, stay safe. Thank you.

The post Attorney Ron Drescher Speaks With Katherine On “This Needs To Be Said” About A Course Called, COMPLETE BANKRUPTCY. appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Transcript of COMPLETE BANKRUPTCY Mastermind Session: Planning Worksheet appeared first on Baltimore Bankruptcy Lawyer.

]]>PlanningWorksheetCOMPLETEBANKRUPTCY (1) (1)

Okay. So, this is the heart and soul of a Chapter 13 analysis. What we’re trying to do is bring together in one analysis, all the different components that you’re going to see as part of a Chapter 13 plan. And another thing that I have just so we have it and it’s up and running is the Chapter 13 plan. This is a form, it’s a standard form that is used in cases around the country. Every district has its form for a Chapter 13, but they’re all based upon the national form. Some districts just like to put a lot more into the form than Maryland does. That’s based upon input from the lawyers and the judges and the trustees of that district. I’m just showing you this now. We are going to get back to this in a second to show you how what we do in the planning worksheet that results in populating the Chapter 13 plan. We’re back to the worksheet.

When we look at this thing here, these are the mortgage arrears. We’re assuming, at this point that we are in a Chapter 13 and that our client is behind on the mortgage. One of the most popular reasons to use Chapter 13 is to cure mortgage arrears. This number here typically comes from the proof of claim that the lender has filed with the court. Your client is going to come to you, and they’re going to say I’m about $14,000 behind on the mortgage. They’re going to have a stroke when the number comes in $5,000 or $6,000 higher than they projected because they’re usually omitting a month or two. They’re omitting the cost of the foreclosure sale and the attorney’s fees that the lender is permitted to include as part of its proof of claim. When you file your original plan, which you should file with the petition. There’s one reason, more than any other, that you should file your original plan with the petition. This reason is that the bankruptcy court will send a copy of it to all creditors that you include on the creditor list that you file with the petition. You’re going to get one mailing on the bankruptcy court’s dime. You know, that matters because if you have to amend the plans several times during the course of the case and every time you amend it, you have to serve all parties and interests.

That could get expensive between photocopying and postage after a while. I like to get one free bite, no matter what. Even if I’m filing a barebones case on the eve of a foreclosure sale, I at least like to file some kind of plan if I can and that will include the arrears that my client brings to me. So, here, we see that this amount, this $19,417 comes from their proof of claim. We’re going to go back to the sample plan. This is the plan, and this is the amount. Wells Fargo Financial is the lienholder of the mortgage and the amount of the arrears is $19,417. Let’s share the whole thing. So here it is, the $19,417 is what we saw in the plan and then – here, you know what, let’s see if I can make this a little bit cleaner going back and forth. Let’s see if I can get the plan up here as well. This will make it easier to go back and forth. I came up with this interest rate of 5.5 percent from the Supreme Court Till case in which you take the prime rate of interest and you add 1, 2, or 3 percent to compensate the lender for risk. And you’ll see here I’ve brought that in over here as well and then, this is prepopulated. This is a formula that’s prepopulated to come up with the payment.

So, if we change this, let’s say to $20,000, that will change the dollar amount here. If we change the length of the plan, that changes the dollar amount. It also changes the dollar amount down here. If you change the interest rate, that also changes everything. So, everything is incorporated here, that’s why it’s such a useful tool. So, we’re going to go back to what it was before. We’ll make it 60 months. Here’s the rule of thumb for how long your plan should be. If you have dollar amounts that have to be paid as part of the Chapter 13 case such as secured arrears or priority taxes or buying back the equity from the creditors. You usually want to stretch it out as long as possible so that the payment is lower because Chapter 13 debtors are intensely cash flow oriented. Perhaps you have a situation where you’re just trying to get rid of toll violations. I had a client who has $35,000 worth of toll violations. How you do that? I can’t figure it out, but they do. They have that many toll violations. They came to me. This was a funny case because I was going through their initial consult. We were talking about their credit cards and their medical bills and their evictions and their repo. I said is there any other debts that we ought to be talking about. They said well, I have some toll violations. I said how much. The client said $35,000. Right then and there, I said we’re going into a Chapter 13 because you can get rid of toll violations in a 13. You can’t get rid of them in a 7.

Because that’s what we’re trying, this would have been a no-asset case. They’re a below-median income debtor, so we want to make this a 36-month plan where we’re not going to pay anything to the unsecured creditors. He didn’t have any priority taxes. He didn’t have any equity in his property. The payment is going to be as low as it could be anyway. Let’s do it over 36 months yielding a much better outcome for the client. That’s how we analyze those cases.

Question: And was there any reduction in that because it is a municipal fine? Is there any reduction in that in a Chapter 13?

Ron Drescher: I’m going to jump back into the green section in an effort to answer your question. The amount of the dischargeable unsecured debt is not a factor in determining how your plan payment, unless your equity is greater than the amount of unsecured claims. You don’t have to pay back any part of the unsecured debt in a Chapter 13 case. Although around the country, there are some trustees and courts that say well, if you are not paying at least something to unsecured creditors, that shows a lack of good faith. Therefore, we’re not going to confirm your plan. That’s how they shoehorn a payment requirement into the plan process that is not there. There is no statutory requirement to pay anything to general unsecured creditors.

My gut feeling is if you have a jurisdiction where the trustee says, you are going to pay 25 percent to general unsecured creditors, otherwise, I’m not going to recommend confirmation of the plan. My feeling is you should push back at him or her and go to the judge. You say “Judge, this is my client, he’s an honest hardworking person that ran into some trouble and they just can’t afford 25 percent.” The judge may still confirm a plan that pays less. But you should know there is no requirement under the Bankruptcy Code to pay anything to general unsecured creditors. There is no need to stretch out that $35,000. It’s a dischargeable, general, unsecured claim in Chapter 13. But, in Chapter 7, it’s non-dischargeable because just as you said, it’s a municipal fine. Municipal fines that are civil in nature are dischargeable in Chapter 13 but not in Chapter 7. That’s one of the reasons why sometimes you’ll do a Chapter 13 because you’ve got a client with big fines.

By the way, we’re going to go now to this section. Here is the Chapter 7 test called the buy-back equity test. This is also prepopulated with a formula. These numbers can change because every situation is going to be different. Any time somebody has a house, I run these numbers–the fair market value. During the initial consult, I’ll quickly run numbers from redfin.com, Zillow.com, and realtor.com. I try to get a sense of an average between those three and then I’ll plug that number in over here. The cost of sale, you can see I stick that in here. I use an 8 percent cost of sale. You could probably get away with a 10 percent cost of sale. Then, this is the mortgage. If there is a HELOC, a home equity line of credit, or any second mortgage, I stick that in here. If there are judgments that have become liens against the property, I stick that in here. I stick the homestead and other available exemptions in here and come up with the net number. You’ll see the net number of $33,200.

You could see that I’ve put that up here as the formula that’s baked into the spreadsheet. This $33,200 appears over here and then it’s divided by 60 because that’s the proposed length of the plan. Now, let’s say the amount is $200,000. This amount comes down to $1,000 and that automatically populates over here. If this amount is negative, what you should do. You know what, I could probably make this so that this number can never be negative. If I were a little bit better in Excel. I could probably tweak this so that this is never negative. This is the dollar amount here. See, this matches here. This should never be negative. But once this is negative, then you never have to worry about this section. Then you’re only going to be talking about the amount of the arrears if you’re going to be paying a car through the plan or if you are going to have priority claims because there are taxes. So, now, do I have any questions about how the part regarding the arrears and the restructured value works? So, do you have a question? Oh, okay, you’ve got your answer, lower the hand.

Now, we’re going to talk about this restructured value. Sometimes, you want to pay the car through the plan. Usually, you want to do that when you have a client who comes in with this situation. They had a car that was underwater long before they came to see you. They decided they wanted to get out from under that car and they want to get a new car, so they go to the dealer and they’re going to trade in the car. Now, the dealer doesn’t care. The dealer is just trying to put this person into a new car. So, the dealer is going to figure out a way to roll the negative equity of the existing car into the new car. By the time your client drives off that lot, they are already crazy underwater with their new car, and they have a monstrous payment. Okay, in that situation which is way more common than it should be, it would be great if instead of having your client pay the amount of money that is due, the total amount of the claim, just pay the value of the car.

In that case, we go down to this yellow box here because this deals with the 910-day rule. The client must have had the car for 910 days before you can cram it down to the value of the car instead of to the amount of the debt. This is easy enough. This is the day you bought the car. This is the day you filed the case if that amount is over 910. You can go back up here and put in the dollar amount of the clean retail value of the car. It is going to be clean retail value. It’s not regular value. It’s certainly not trade-in value. It’s the clean retail value.

The reason for that is for years and years and years, there were fights in the bankruptcy court about what value to use. Lenders always wanted the highest possible value; debtors always wanted the lowest possible value. Finally, in 2005, they changed the Bankruptcy Code, hard to believe it was that long ago, they established clean retail value. If the debtor is going to keep the vehicle, you always use clean retail value for this analysis. So, I have this at zero dollars. If the clean retail value is $16,000 and this is the till rate of interest. We don’t use the contract rate. We use the prime rate plus that 1, 2, or 3 percent that the Supreme Court told us we could use. We’re going to have a payment of $306 a month. If they come to your office or they talk to you on the phone, and their payment is $600 a month, you’re saving them a ton of money over the life of the plan—60 times $200, that’s $12,000. To me, that’s probably worth this $6,000 that we’re charging them. We’re going to get to this in a second. This is very important. The trustee’s commission which I always calculate as 10 percent.

Sometimes, you’re going to have a client that’s going to come to you that’s paying 19 or 20 or 21 percent on the car but they haven’t had it for 910 days. You can still pay that through the plan and lower the interest rate to this 5.5 percent which, sometimes, is miraculous. But don’t forget, you’re going to have to add this trustee commission which I figure at 10 percent. So, even if you can reduce it to 6 percent or 5½ percent, you still going to add that 10 percent on because the trustee is charging 10 percent for every dollar that comes through his or her hands. So, you need to consider that in deciding if it’s worth the effort to restructure a car to reduce the interest rate. For me, I think it’s usually not worth it. Also, because at some point during the Chapter 13 case, you’re going to get a call and the client is going to say, I want to get a new car. Can I get a new car? In the best-case scenario, you’ll have to modify the plan, surrender the car, get into a fight with the lender about whether or not you can surrender the car, and then discharge the deficiency claim along with the other unsecured claims. It’s a headache.

You have to consider from the get-go, whether it’s worth doing that at all. It may not be. In my opinion, it’s seldom worth reducing the interest rate but it is almost always worth it if the car has been in your client’s hands for more than 910 days, reducing the amount of the claim to the value of the car. One caveat for the 910-day rule is that only goes to purchase money. You’re going to have clients that are going to come to you, and they took out a title loan on a car. Some lender was willing to give them a loan against the value of the car—maybe the car had been paid off, but they’ll give you a title loan. For that loan, you don’t have to wait the 910 days. So, that’s a question you always ask. Did you ever do a title loan? All right, so let’s go back and let’s make this, what was this, I think this was 230. I think that was $235,000. Right, and that brought us back to the $33,200. Let’s put this back at 0. We have decided not to pay a car through the plan and this unsecured debt payout is $33,200 because they’ve got substantial equity in their home. Now for fees, this is important because they’re paying your fees through the plan.

That’s a great thing for them and it’s a great thing for you. And now, if we go to the plan, we see where that appears. That’s going to appear in this section where they’re talking about administrative claims. That’s going to be $6,000. So, that’s $6,000 here and that $6,000 appears here. I put that in there and I explain to the client that it’s going to turn out that they’re not paying this out-of-pocket. They are paying over to the trustee and I’m going to be paid $100 a month from their payment. And you know, clients don’t typically oppose $100 a month during the Chapter 13 case. The important thing is I’m setting this up psychologically, right here, during the initial consult that this is going to be my additional fee. In addition to the $1,500, I’m going to charge to put them into the Chapter 13 in the first place. That’s the important function that discussing this over here does. Besides the fact that you must calculate your fee to have the client have an idea of what they’re going to pay as part of the Chapter 13 case. Next, we come to priority claims. This is an extremely high number. You are seldom going to see a case with a number this high. They are typically IRS taxes. The IRS in Chapter 13 cases is great. Seldom are you going to have the words IRS and great in the same sentence.

You will get it here because they file their claims on the first day, most of the time, or in the first week. Most of the time, you know right away what the IRS debt is going to be that you’re going to have to pay through the plan. I don’t have an example here. I’m going to put up in the course, an example of the IRS claim. It’s nice. They have it spread it out as these are the priority claims. These are the general unsecured claims. If there is a notice of tax lien that they filed and they are secured claims, they put that in the years. Enormous practice tip, all right? This is a writer-downer. Let’s say your client comes to you and tells you that they’ve got tax debts and there’s a notice of lien that’s been filed. They usually know that the IRS has a lien. Let’s say they don’t have any equity in any of the other assets that they have. They would otherwise be a perfect no-asset case. But, for whatever reason, we have them in a Chapter 13. The notice of tax lien filing hits all their assets. The debtor does not have any right to exempt any part of their assets relative to the IRS, unlike judgment creditors where you get the benefit of your exemptions.

You don’t get the benefit of your exemptions from the IRS. Maybe you’re in Florida or Texas or California or Delaware or one of those states that has a great homestead exemption, it doesn’t do any good against the IRS. They defeat that. But let’s say you don’t have a lot of assets and you would have ordinarily a no-asset case and the debtor, the client, says, “Well, I’ve got furniture worth $2,500; I’ve got an IRA that has $5,000; I’ve got a bank account with some money. Whatever they have, those assets, that’s going to be the amount of their secured claim that needs to be paid as part of the Chapter 13 case. Now, the value of furniture and clothes and jewelry and artwork and your kids’ bicycles, and such, is highly subjective. Nobody ever loses this stuff in a bankruptcy case. But whatever dollar amount you put on those bankruptcy schedules for the value of those assets, you’re going to be stuck with that with the IRS secured claim that you’re going to have to pay through the Chapter 13 plan. That number is going to go up either here or here depending on the situation. And you’ll have to run that analysis.

So, if it turns out it’s $11,000, that’s going to add $210 a month to the plan, plus the trustee’s commission. If you know that the IRS is going to be asserting a tax lien, maybe you err on the side of a lower valuation on your assets of household goods. There’s wiggle room in the valuation of furniture. No one’s coming to their house to value this stuff. It’s not fraudulent. Right? Who knows? I got a crib. What’s that crib worth? Is that crib worth $200? Is it worth $75? I use Craigslist values which, frankly, is free if you’ll come and get it. That’s an important practice tip when you are dealing with somebody who has an IRS tax claim. We’ve gone down here. These are the priority claims. We talked about that. What we did here is we added all the different constituents of the claims to configure the trustee’s commission of 10 percent. That’s how we come up with the $9,583. Now, for the estimated plan payment, we just add all of the sub-payments and we come up with the plan payment right here. This is not intended to be a primer on how to draft a Chapter 13 plan. We’ll get to that at another time.

Much of what I’m talking about is going to come into play but it’s more how, when you’re on the fly, to come up with a dollar amount that you can tell your clients. Yeah, this is what your payment is going to have to be. Now, this number, they will always underestimate. This number, we usually have a fairly good idea. Very seldom is a Chapter 13 trustee going to challenge you on the value that you put in for the real estate. That is rarely going to happen. So, you can predict easily what you’re going to get there. Priority claims, they’re going to crazy underestimate this amount. I thought I owed the IRS $22,000 and then the priority claim comes in at $37,000. Another thing that, I used to have a full head of hair before I did this. Another thing that drives you crazy is the state. While the IRS typically files their proof claim in the first week, the state taxing authorities may wait until the deadline, a day before the deadline which is 180 days in most Chapter 13 cases. So, a lot of times, you must go to your confirmation hearing before you know what the state’s tax claim is going to be. But, in that case, that’s all right, you modify the plan. You want to modify the plan, great, you do your motion to modify. I don’t have a form up there yet on that, but we’re going to. You have the proposed modified plan. You are going to circulate that to all parties and interests. That’s another $28, $32, $17, whatever. You keep doing that and it does strip away at your fee, especially if you have the no-look fee in your jurisdiction. This is the dollar amount. I have this in the plan over here. Estimated plan payment, $1,912; $1,912 for 60 months. So, now you have an idea of how your plan is beginning to take shape just through using this tool.

All right, I have a couple of other items. I’m almost done. That’s the guts of the tool. Sometimes, I will go through this pink section here with the client where I try to go through what their net disposable income is going to be. This is not as useful a section, in my opinion, as the green section because you are estimating a lot of things. It doesn’t include all the expenses; although this is a fairly decent summary of the expenses that they’re going to see and that they’re going to be allowed to take. This is a fairly good estimate of their take-home pay. I can come maybe within shooting range of net disposable income using this. So, I put it in here. I think it’s a useful tool. If you want to play with this document, feel free to make whatever changes you want to it. It’s yours to use however you want to, but this typically is relatively close to getting within a stone’s throw of this you’re an NFL quarterback and you’re throwing the stone.

You’re more likely to hit your target than if I’m throwing the stone. These other two sections here, we talked about this. This blue section is a useful tool that has nothing to do with the dollar amount of the Chapter 13 payment. I created this to kind of give my clients an idea as to whether or not they’ll qualify for a Chapter 7 case because their non-consumer debt is higher than their consumer debt. This is a great back door when you have a client that had a business that failed and they’re holding the bag for the business debt but they’ve got another job or their spouse has a good-paying job, and they’re above median and they’ve got a mortgage. I put this mortgage up high. This mortgage of $655,000 versus all these different debts relative to their failed business of $381,000. Because the mortgage is higher than the $381,000, this client would not qualify for Chapter 7. Even though I’m paying the mortgage current and we’re going to keep it out of the bankruptcy, it had nothing to do with anything and it’s not why I’m filing bankruptcy. Doesn’t matter. Doesn’t matter. Because it’s a consumer debt, you have to count it.

In comparing the consumer debt versus the non-consumer debt, I want you to notice that I don’t call it business debt because it’s not consumer debt versus business debt. It’s consumer debt versus non-consumer debt. Consumer debt is defined as debt that was accrued primarily for personal, family, or household purposes. If it doesn’t fit into one of those three categories, it goes on the non-consumer side. So, for example, taxes are never consumer debt. That’s key, that’s huge. A mortgage is almost always consumer debt, but let’s look at a situation where your client had a home equity line of credit that they used to finance their failed business operations. That debt was incurred for other than primarily personal, household, or family purposes. You can include that in the non-consumer side. You must ask the question. You’re going to have clients that will come to you because they had a failed business and they will be high-income debtors. You are going to see those clients. If you can get them to have this non-consumer side higher than the consumer side when every other lawyer in town told them they’re going to be stuck in a Chapter 13, but you can get them into a Chapter 7. You’ll be the most amazing superhero and that is going to happen.

I’m going to throw two things at you that has nothing to do with this, but I think they’re great little tidbits if you’re trying to get your client into a Chapter 7. One is if they’re a franchisee. After COVID, many, many, many franchisees are going to be going into bankruptcy. You might handle their personal. You might handle their business case. What’s more likely is that you’re going to handle their individual case and a lot of the franchisees opened up the franchise after they have another high-paying job, their spouse has a high-paying job, and they’re going to over median. The franchise failed. There are royalty fees and other franchise fees in connection with a franchise agreement. That might go for 8 to 10 years. I think you can calculate that out over 10 years and include that on the non-consumer side.

I’ve had several clients that I have been able to get into Chapter 7 cases that never thought they were going to get into a Chapter 7 case because of all the reasons we have discussed. That is the tip, and this is a spreadsheet. This is a calculation that you will find yourself doing. I have it in this spreadsheet. You’ll also notice that I use Chrome, and this is a Google Sheets document. Initially, it was in Excel, but I brought it over to Google Sheets. I have it right here in the upper left-hand corner. I will go to this all time. I’ll make a copy of it and save it in the client’s file on their Google drive. This way, it is the easiest possible access to this document because I use it so often. I hope you found this deep dive into this tool to be useful. I know I kinda threw it at everybody during bankruptcy week. I did that semi-intentionally because I thought that if you took the time to analyze, you might have been able to figure it out. I knew that it would come in handy to have this time to go through it. I hope that this was time well spent for you. Does anybody have any questions about this tool or any of the things that we have talked about?

The post Transcript of COMPLETE BANKRUPTCY Mastermind Session: Planning Worksheet appeared first on Baltimore Bankruptcy Lawyer.

]]>The post The Bankruptcy Of Santa’s Workshop appeared first on Baltimore Bankruptcy Lawyer.

]]>

The post The Bankruptcy Of Santa’s Workshop appeared first on Baltimore Bankruptcy Lawyer.

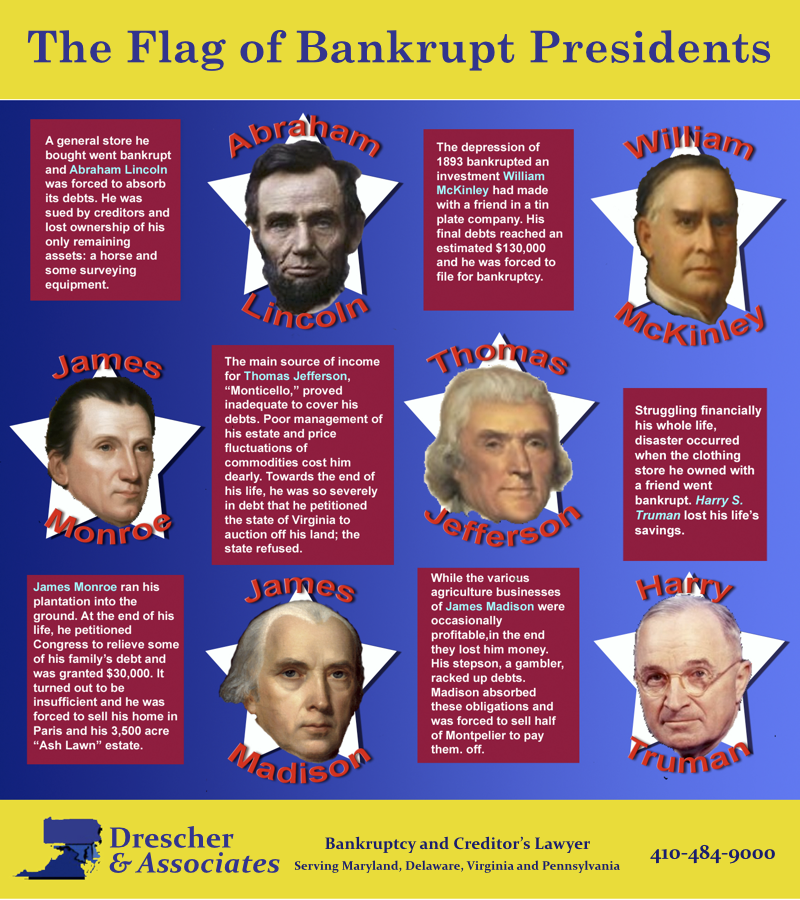

]]>The post The Flag Of Bankrupt Presidents appeared first on Baltimore Bankruptcy Lawyer.

]]>

Certainly the most conspicuous president on this Flag is Abraham Lincoln, who suffered from depression and cash shortages his whole life. A failed business; the challenge in finding your best place in life; destructive spending habits; and fights in the marriage remain as emotional weights for many of us in the struggle to cope with unmanageable debt. Abraham Lincoln won and lost; won again and lost again in his very human saga on the way to immortality.

The post The Flag Of Bankrupt Presidents appeared first on Baltimore Bankruptcy Lawyer.

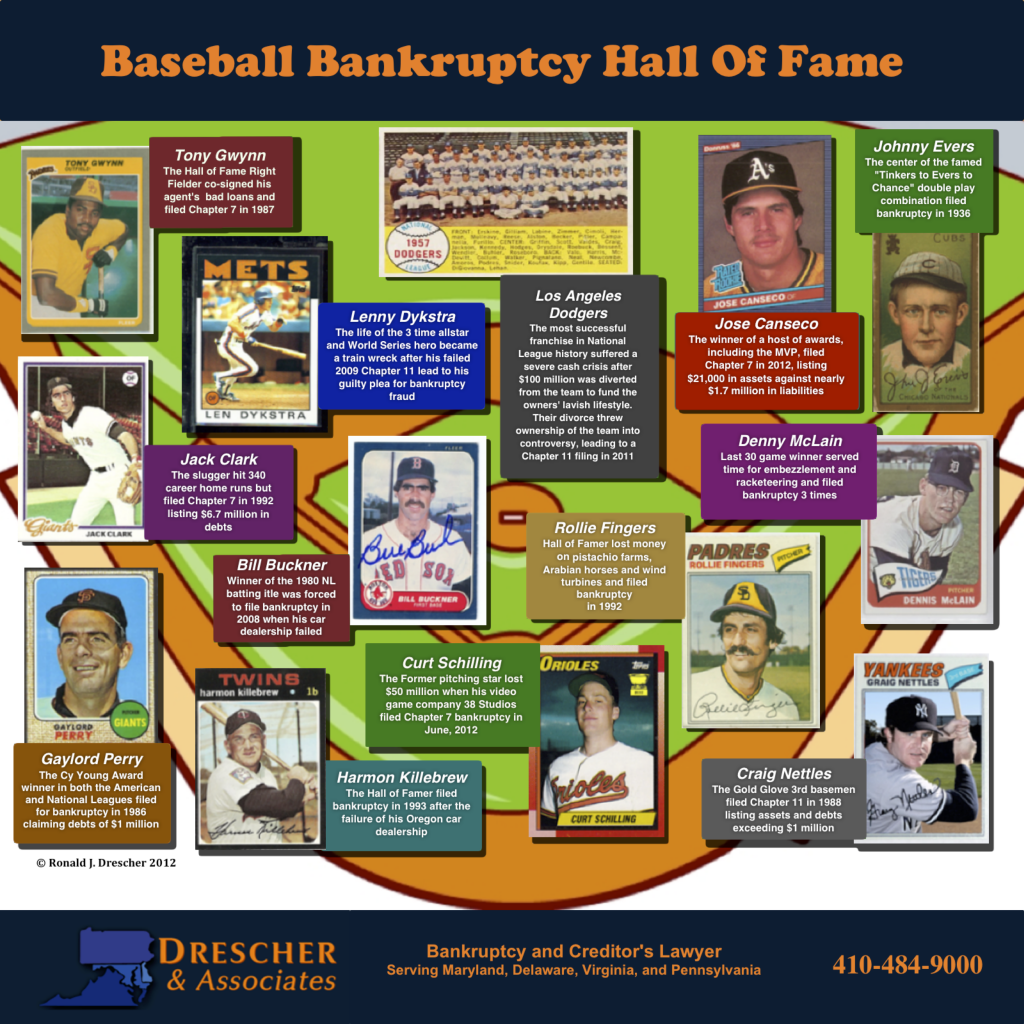

]]>The post The Baseball Bankruptcy Hall Of Fame appeared first on Baltimore Bankruptcy Lawyer.

]]>

By now most people know that fame, talent and big contracts don’t guaranty financial security. Most of the great athletes featured in this infographic The Baseball Bankruptcy Hall of Fame have played in the Fall Classic, but all had to face the facts that they needed help to overcome the dangers of bad investments, bad judgment and bad luck. But one position has never had a bankruptcy filing…click here to see why those who wear the tools of ignorance may be much smarter than we think!

The post The Baseball Bankruptcy Hall Of Fame appeared first on Baltimore Bankruptcy Lawyer.

]]>The post The Single Mom’s Guide to Surviving Summer (Without Wrecking Your Budget) appeared first on Baltimore Bankruptcy Lawyer.

]]>Finding Child Care

There are camps for nearly every child’s interests but, according to the American Camp Association (ACA), most day camps cost between $200 and $800 per week and overnight camps average $630 – $2000 per week. The good news is that there are much cheaper options available.

- The YMCA offers quality, affordable overnight camps. Use their search tool to find the right one for your child.

- By using public facilities, local Parks and Recreation agencies are able to provide inexpensive summer programming. Better, they often give financial aid and discounts for multiple children.

- Churches, synagogues and other places of worship provide free or very low cost faith-based camps, such as Vacation Bible Schools, and many churches in a community will intentionally schedule their programs for different weeks so that the same children can attend multiple camps. You do not need to be a member of any congregation to enroll your child.

- The Salvation Army has totally free, summer camp programs nationwide— featuring activities like sports, swimming lessons, music and art — for low-income families. Check out the Salvation Army for locations near you.

Having Fun

Hopefully your summer won’t only be about working and juggling childcare. With any luck, you’ll have some time — and money! — for fun. But how can you afford fun when money is always tight and now you’re paying for summer childcare expenses?

- Keep your side hustle, but adjust your hours. Try getting up a little earlier, before anyone else in your house is awake, and devoting that time to making some extra money. Or, if you’re a night owl, use those late night hours after everyone else is asleep for extra work.

- Three Fs — festivals, free events and family (or friends) — will help you stretch your entertainment and travel budgets. Summer is full of festivals and most of them are free. See if you can visit family members or friends who live out of town to scratch your travel itch, and take advantage of free events in their cities while you’re there.

With a little research, some extra hustle and a dash of creativity, you can get your work done, control your spending, and give yourself and your children a great summer, no matter how tiny your budget.

If you’d like more individualized help getting control of your finances, Ronald J. Drescher has been assisting clients with their legal and financial troubles for more than three decades.

The post The Single Mom’s Guide to Surviving Summer (Without Wrecking Your Budget) appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Paying the Price for a Spouse’s Financial Crimes appeared first on Baltimore Bankruptcy Lawyer.

]]>Lisa Lawler split from her husband after she found out he’d had an affair, but it turned out that wasn’t his only lie. It wasn’t even his biggest lie. A month after their split, Lisa discovered he had embezzled $2.5 million from the healthcare company where he worked. He was sentenced to 24 months in prison and Lisa, at 50 years old, had to start over again. She hadn’t worked in 20 years and took the best job she could find: setting up store displays in a big box store, making $14 an hour.

And then more bad news came in the form of a tax bill. Lisa was on the hook for $384,000 in unpaid taxes on the embezzled income her husband hadn’t disclosed. After six months of pleading, she was finally able to get released from the tax obligation, arguing that she couldn’t have been expected to pay taxes on money she didn’t know they had.

Lisa started a blog, The White Collar Wives Project, to share her experiences and provide a place for other women to share theirs.

Jenny, the wife of another convicted white collar criminal, eventually chose to file Chapter 7 bankruptcy in order to get out from under her investment banker husband’s mistakes. He pleaded guilty to a scheme to defraud investors and agreed to pay $5.3 million in restitution to victims and to forfeit $215,000 in proceeds. He was sentenced to 57 months in prison.

Though Jenny divorced him, their house, cars, and nearly everything they owned was seized to satisfy his debts and, like Lisa, Jenny also got personally hit with an $85,000 tax bill and stuck with a $40,000 credit card bill. She moved back in with her parents and took a job waiting tables. Filing bankruptcy, she decided, was the best way to finally get on with her life.

Starting over, even when your circumstances aren’t as dramatic as Lisa’s and Jenny’s, is never easy. When you’re facing a mountain of debt it can be hard to see how you’ll ever get back in control of your finances. Ronald J. Drescher has been assisting clients with their legal and financial troubles for more than three decades. He can help you find your way back to normal.

The post Paying the Price for a Spouse’s Financial Crimes appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Edit Your Life and Take Back Your Time appeared first on Baltimore Bankruptcy Lawyer.

]]>The only way you’re going to simplify and streamline your life is to cut some things out—but where? And what?

1. Set a morning routine.

It may not seem like much, but creating and sticking to a morning routine will set the tone for the rest of your day. Whatever it is that helps you get going in the morning, do it every day, and defend that time. Use your morning ritual to collect your thoughts for the day. Make a list of all the things you need to get done so you don’t forget anything and so you feel ready to take on the day. Bonus: it’s very gratifying to cross those things off your list.

2. Say ‘yes’ less.

Over-extending yourself complicates your life and eats away your free time. Learn to tell others no when you don’t want to do something. Memorize and repeat this line, “No, that’s not going to work for me.”

You don’t owe anyone a reason or an excuse. If the person persists, repeat it again. After the second time, the person will get the message.

3. Unsubscribe.

Is your email inbox full of newsletters you never read? Unsubscribe. Are you bombarded with messages about sales on items you don’t need? Unsubscribe. Do you get magazines you rarely read? Unsubscribe. And, most of all, unsubscribe from subscription box services. You don’t need those things. You probably don’t even want them. And if you don’t forget to log in and skip each month, they’re going to charge you anyway. Unsubscribe, unsubscribe, unsubscribe.

4. Be your own gatekeeper.

Stop answering calls from people you don’t want to talk to, replying to texts you don’t want to reply to, and saying yes to events you don’t want to attend.

If an old friend is still committed to bad habits you want to kick, stop hanging out with her. You don’t have to stop caring about her well-being, but you can care without exposing yourself to her unproductive tendencies. Same goes for social media—unfollow what’s-his-name who offends you on Twitter, Facebook, etc.

Streamlining your life may feel risky at first, but the time and mental clarity you’ll gain make it well worth the effort. The payoff is more time, more money and less stress–and who doesn’t want that?

Need some help getting back on track? Ronald J. Drescher has been assisting clients with their legal and financial troubles for more than three decades.

The post Edit Your Life and Take Back Your Time appeared first on Baltimore Bankruptcy Lawyer.

]]>The post The Masters – A Bankruptcy Unlike Any Other appeared first on Baltimore Bankruptcy Lawyer.

]]>

In the early years of “The Great Depression”, golf immortal Bobby Jones and his colleagues believed that the economy would soon turn around and businessmen in the northeast US would flock to an exclusive golf club open only during the winter months. Like so many others, Jones miscalculated the ravages of the financial downturn and his beloved golf club, Augusta National, found itself in the jaws of financial ruin. I created this infographic to tell the story about how Augusta National and the Masters emerged from the shadows of bankruptcy, foreclosure and debt.

The post The Masters – A Bankruptcy Unlike Any Other appeared first on Baltimore Bankruptcy Lawyer.

]]>