The post The Bankruptcy Red Carpet appeared first on Baltimore Bankruptcy Lawyer.

]]>

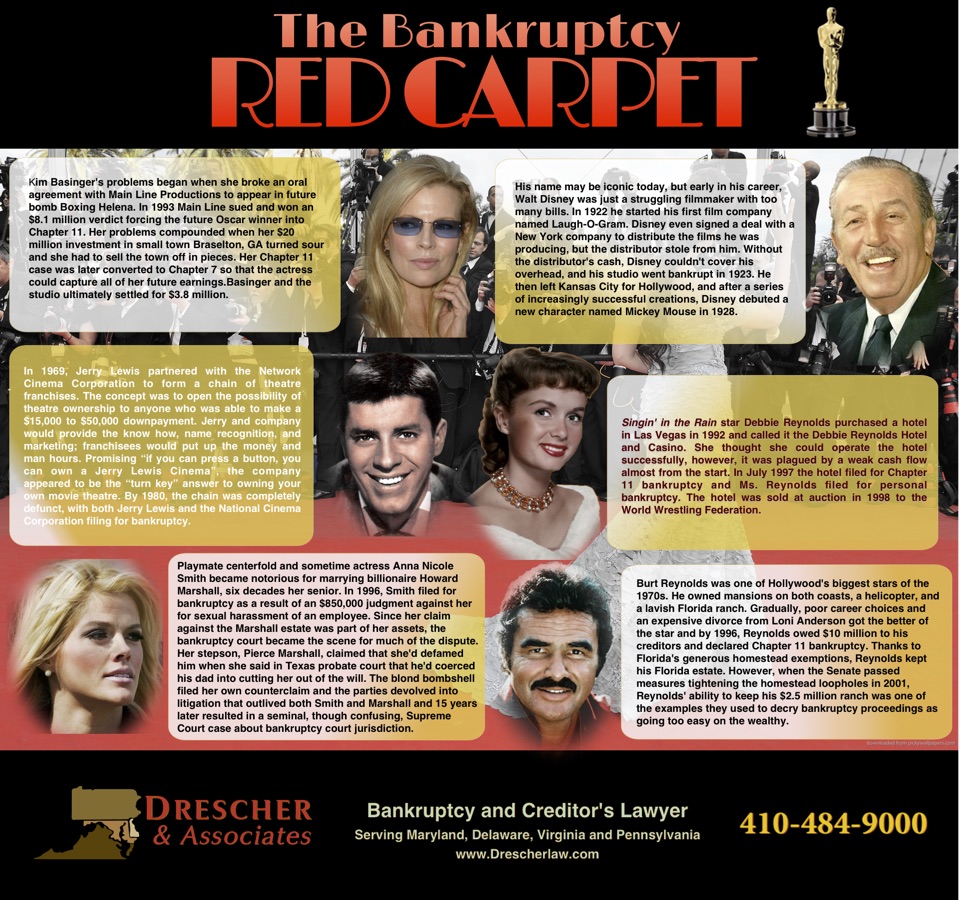

In this season of awards shows, tuxedos and paparazzi it bears remembering that celebrities stumble and fall just like the rest of us. Some bounced back, lifted by their fame and talent, while others struggled through obscurity and financial distress.

The post The Bankruptcy Red Carpet appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Creative Ways for Single Moms to Find Free Time So They Can be More Productive and Have More Fun appeared first on Baltimore Bankruptcy Lawyer.

]]>Stop trying to do it all. Trying to do absolutely everything will leave you exhausted, and exhaustion puts you at risk for getting sick – and you definitely don’t have time to get sick. So listen to your body. Maybe your kids have friends whose moms volunteer for every fieldtrip and make their children lunches with fruit cut to look like flowers. Resist the urge to compete. A strawberry that looks like a rose still tastes like … a strawberry.

Get up on time, and make your bed. Save yourself the stress of playing catch-up all day by getting up on time. Making your bed sets an organized tone for your whole day.

Make a plan and tackle similar tasks in batches. Writing down everything you have to do and grouping similar tasks together makes life easier to manage. Consolidating your activities will allow you to push efficiently through one set of tasks and then move on to the next. Sit down and make all of your phone calls in one setting, then respond to all of your emails, then pay your bills, each at pre-determined times during your day. This week keep you from ping-ponging from one task to another, and wasting valuable time.

But build in buffer time. Don’t assume there will be no traffic, that you’ll leave work on time, or that your child will happily jump into homework and finish it exactly 30 minutes later. Give yourself some wiggle room in your plan so that you won’t have to constantly rearrange your schedule.

Make a daily to-do list. Use an old-fashioned written planner to jot down all the things you need to do each day. Write down the big things and the small things, even tasks as small as unloading the dishwasher, and cross off each thing as you finish it. It is incredibly motivating to see all that you are accomplishing and it will make you push yourself to mark off each next thing. Don’t be surprised when your list is finished before the day is done.

Create a routine, then stick to it. Having a daily routine is a great way to protect your time. Instead of flailing about from one thing to the next, you’ll find yourself automatically accomplishing the things that need to be done.

Adopting a few of these habits will help you organize your day and your responsibilities and maximize the time you have so that you find yourself with time for the things you really want to do.

Want some help getting your financial life in order? Ronald J. Drescher has been assisting clients with their legal and financial troubles for more than three decades.

The post Creative Ways for Single Moms to Find Free Time So They Can be More Productive and Have More Fun appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Personal Finance Concepts Every Single Mom Should Know appeared first on Baltimore Bankruptcy Lawyer.

]]>Know what you owe. Add up all your debt–student loans, mortgage, car loans, credit card balances and any other debt. You need to know how much you owe, to whom, how you’re paying it off, how long it will take to pay it off, and the interest rate you’re being charged.

Know how much you make. For a lot of people, their salary is their main income. But you may also have other income sources, such as income from a side job, tips, alimony, child support, and tax refunds. Knowing how much money is coming in to your bank account will help you understand your entire financial picture for budgeting purposes, and it will help you make sure you aren’t overpaying or underpaying on your taxes.

Know how much you spend. Just as you need to know how much is coming in, you definitely need to know how much is going out. This doesn’t mean you have to account for every penny – unless you want to! It’s enough for you to just have a broad sense of how much you’re spending in the major budget categories, such as housing, food, childcare and transportation. Once you know what you have to spend, you can create a budget so that you know how much you have left, then you can look for ways to slash your expenses and start saving!

Manage your own money. This is important for all women, and especially important for single moms. You may have had a man in your life in the past who took control of the finances – and you may have a man in your future who wants to do that, too. The truth is that women tend to live longer than men, so even in the happiest of relationships, the woman may find herself trying to make sense of a financial system she didn’t create after the man in her life is gone. And, of course, not all relationships stay in the “happy” category. You earned your money. Devise a system that makes sense to you, and then manage that system yourself.

Talk to your children about money. There is no shame in explaining your financial situation to your kids once they’re old enough to understand. Choose your words wisely because you don’t want to frighten them, but do explain your reality. When your children understand the need to be frugal, they can help you live within your means. And, learning these finance fundamentals now will set them up for their own healthy financial future.

Want some help putting together a financial plan? Ronald J. Drescher has been assisting clients with their legal and financial troubles for more than three decades.

The post Personal Finance Concepts Every Single Mom Should Know appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Single Moms Who Turned Their Ideas into Dollars appeared first on Baltimore Bankruptcy Lawyer.

]]>And surely by now you’ve heard J.K. Rowling’s amazing story? How she went from being a struggling single mom on welfare to being the world’s most successful author. “I was a Single Parent, and a ‘Single Parent On Benefits’ to boot. Patronage was almost as hard to bear as stigmatization,” Rowling wrote in an essay. “I would say to any single parent currently feeling the weight of stereotype or stigmatization that I am prouder of my years as a single mother than of any other part of my life.”

Or how about Hollywood hotshot Shonda Rhimes, the mastermind behind Gray’s Anatomy, Scandal, How to Get Away with Murder, and Private Practice. Rhimes isn’t just a powerplayer in an incredibly competitive industry, she’s the single mother to three daughters. “…I want my daughters to see me and know that I am the one who works. I wouldn’t want them to know the me who didn’t get to do this all day long,” Rhimes says.

But there are many, many more stories of single mothers doing incredible things. Most of those women will never become famous, but they’re carving out their own success, day in and day out, in nearly every industry and corner of life.

Consider Lisa Stone. In 2005, Stone, a young, divorced, single mom of three, founded the online platform BlogHer. Not only did she create a fantastic business for herself, but she created a community where other women like herself could launch their own careers and dreams and gain access to wider professional circles and exposure.

And Melissa Kieling. In 2008, Kieling, a single mom of three, founded PackIt after her kids complained that the blueberries she packed in their lunches were warm and mushy. At the time Kieling had virtually no business experience. The closest she’d come to the marketplace, she said, was volunteering at school bake sales. Now she runs an $11 million corporation. “Not knowing which steps to take first nearly paralyzed me with fear, Kieling says. “I overcame this by reaching out to other business owners who could connect me to experts in manufacturing, production and sales. Each key person I met shortened my learning curve and gave me confidence. You’ll be pleasantly surprised by how other small business owners want to pay it forward and see new upstarts succeed.”

In fact, you might be surprised by how many famous and successful women are raising their children without a partner. Check out this list of 100 famous single moms , read about these hard working mamas, these solo mothering successes and these mom-preneurs who turned their wits and work into dollars while raising their kids alone.

The post Single Moms Who Turned Their Ideas into Dollars appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Three Great Podcasts for Single Moms Who Want to Save Money appeared first on Baltimore Bankruptcy Lawyer.

]]>But, with more than half a million active podcasts with nearly 20 million episodes available online, finding podcasts that are active, useful, engaging and well-produced can be difficult. To save you the hassle—because who has time for that?—here are three great podcasts for single mothers who want to take control of their finances.

Like a Mother

Veteran money writer, single mom and blogger Emma Johnson takes her popular Wealthy Single Mommy blog and puts it into audio form on her Like A Mother podcast. A former Associated Press Financial Wire reporter and MSN Money columnist, Johnson’s blog and podcast explore issues pertinent to single moms, like investing, entrepreneurship, how to get dads to pay child support, getting out of debt, overcoming a spending addiction, affordable travel with kids, and topics related to business and career, sex, relationships and parenting.

Money Girl’s Quick and Dirty Tips for a Richer Life

Host Laura Adams provides short and friendly personal finance advice inspired by current events, social media, listener feedback and everyday interactions. Though her content isn’t exclusively geared to single moms, her female forward perspective and universally helpful advice is useful to women whether they’re raising kids alone, with a partner, or not at all. Each episode is under 15 minutes long, and jam-packed with actionable advice listeners can use right away.

Martinis and Your Money

This award-winning personal finance podcast presents advice on a variety of financial topics, with an emphasis on the issues that tend to really hit home for women. Host Shannon McLay is an entrepreneur, author and personal finance expert and she brings her lighthearted, fun approach to every episode.

Want some more help climbing out of your financial hole? Ronald J. Drescher has been assisting clients with their legal and financial troubles for more than three decades.

The post Three Great Podcasts for Single Moms Who Want to Save Money appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Dream With Your Eyes Open appeared first on Baltimore Bankruptcy Lawyer.

]]> Dr. Martin Luther King Jr. had a dream. He looked around the world and decided it could be a better place. There’s probably no more famous dreamer than Dr. King. With his eyes open he told us about his vision for dignity, equality, and justice.

Dr. Martin Luther King Jr. had a dream. He looked around the world and decided it could be a better place. There’s probably no more famous dreamer than Dr. King. With his eyes open he told us about his vision for dignity, equality, and justice.

It’s easy to turn off the world. We can let bills pile up unopened. We can ignore calls from numbers we don’t recognize. We can turn away from the bank statements that show we have no money left this month. We can simply close our eyes and pretend that our problems don’t exist. But we all know that just shutting out the light won’t make our life better than it is.

When do our eyes open? Sometimes this happens outside our control. The sheriff knocks on the door with a lawsuit. Our house is scheduled for a foreclosure. Our wages are garnished. Our car is missing from the driveway. We can’t rent an apartment because we have bad credit. It’s awful when we get woken up by a cold slap in the face.

Our eyes can open in other ways too. We can take deep breaths and ask questions. We can get help. We can take a look around every part of our lives and decide “this can be better.”

Your life can be better too. You don’t have to hide from the world, and you can start building a better future. Some people believe that bankruptcy is the hard bottom of a terrible fall, but I don’t. I see bankruptcy as the beginning of a climb towards a better life, a reconnection with the world and an opportunity for financial security.

The post Dream With Your Eyes Open appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Shift How You Think About Money for Your Best Year Yet appeared first on Baltimore Bankruptcy Lawyer.

]]>Just say no…to impulse buys for yourself and your kids. You know the scenario, you’re walking the aisles of a big box store and you see something for only $5, so you toss it in your cart. Or you’re on the couch, scrolling shopping sites on your phone, and you click “Buy It Now” without even thinking. Stop. When you buy a “just $5” impulse item 20 times a month, you’re blowing $100 on things you don’t even need, things you might not even want. Try instituting a 72-hour rule for all purchases, instead. If you wait three days and you still need it, buy it. Chances are, though, after three days you won’t even remember wanting it.

The same is true for your children, but with kids it’s more important than just saving the money. You’re teaching them the attitude they should have toward spending. If you model to them that instant gratification and indulgence are normal and fine, you’re setting them up to have their own spending problems in the future.

On the same note…Live BENEATH your means (and save the rest). Living within your means is good and it’s definitely a start, but it guarantees you and your family a paycheck-to-paycheck existence. Live on less than you make and you’ll start building wealth and security.

Know where your money goes. Until you track your spending and budget for your expenses, you’ll keep hemorrhaging cash—and falling behind.

Don’t shop with credit cards. Paying with only cash or your debit card will keep you disciplined because it’s real money and it hurts to see it go. You’ll likely spend less than you would if you were shopping with a credit card, because you know you can’t just pay it off later.

Love the house and car you’re in. You don’t need to trade up just because you start making more money. The longer you drive a paid off car, the more money you’ll have in the bank. And if you can keep your house payment the same after you manage to land a raise, that’ll be more money you can set aside for the things you really want to do—like retire!

2019 can be your best financial year yet. It can be the year you finally get ahead and start building wealth. All it takes is a slight shift in how you think about money.

The post Shift How You Think About Money for Your Best Year Yet appeared first on Baltimore Bankruptcy Lawyer.

]]>The post The Most Insightful Pieces of Financial Wisdom of 2018 for People Struggling with Debt appeared first on Baltimore Bankruptcy Lawyer.

]]>Many of the wealthiest people in the world weren’t born that way—they built their empires and saved their cash through making smart choices. Read this wealth building advice from titans like Warren Buffet, Oprah Winfrey, Mark Cuban and Tony Robbins.

How working a job you love, delaying gratification, and spending your money on experiences rather than things and other advice people can use to set themselves up for wealth later in life.

It’s hard to get ahead when there’s no cushion in your bank account. Here’s how to save money, even when your paycheck barely covers your expenses.

Speaking of, seeing that $0 balance in your checking account at the end of each pay period is depressing and stressful. What if you were able to have a little left over to save, even without your income increasing? Follow these suggestions and say goodbye to living paycheck to paycheck.

How opting for a little less convenience, designating days to spend no money at all, and filling your grocery cart—and then removing five items before paying—will leave you with a much fatter wallet.

Should you establish a healthy emergency fund or pay of your debts first? Which is more important? Though experts tend to be evenly divided on which is the wisest course, these experts say that the best approach is to divide your money in half and do both simultaneously.

There have never been more resources available to help you manage your money, but with so much information out there, assessing those resources can be like drinking from a fire hose. How do you know which ones are really worth your time and trust? Here are seven of the best resources available for a free personal finance education.

No matter what your financial goals are, achieving them starts with education. Until you know how to get to your destination, you’re unlikely to get there. By knowing where you stand, knowing where your money is going, and knowing where you want to be, you can start on the road to financial recovery.

Now is a great time to revisit the smart lessons from the past year so they’re fresh on your mind for the new year. Need some help climbing out of your financial hole? Ronald J. Drescher has been assisting clients with their legal and financial troubles for more than three decades.

The post The Most Insightful Pieces of Financial Wisdom of 2018 for People Struggling with Debt appeared first on Baltimore Bankruptcy Lawyer.

]]>The post NFL Bankruptcy Tailgate Party appeared first on Baltimore Bankruptcy Lawyer.

]]>

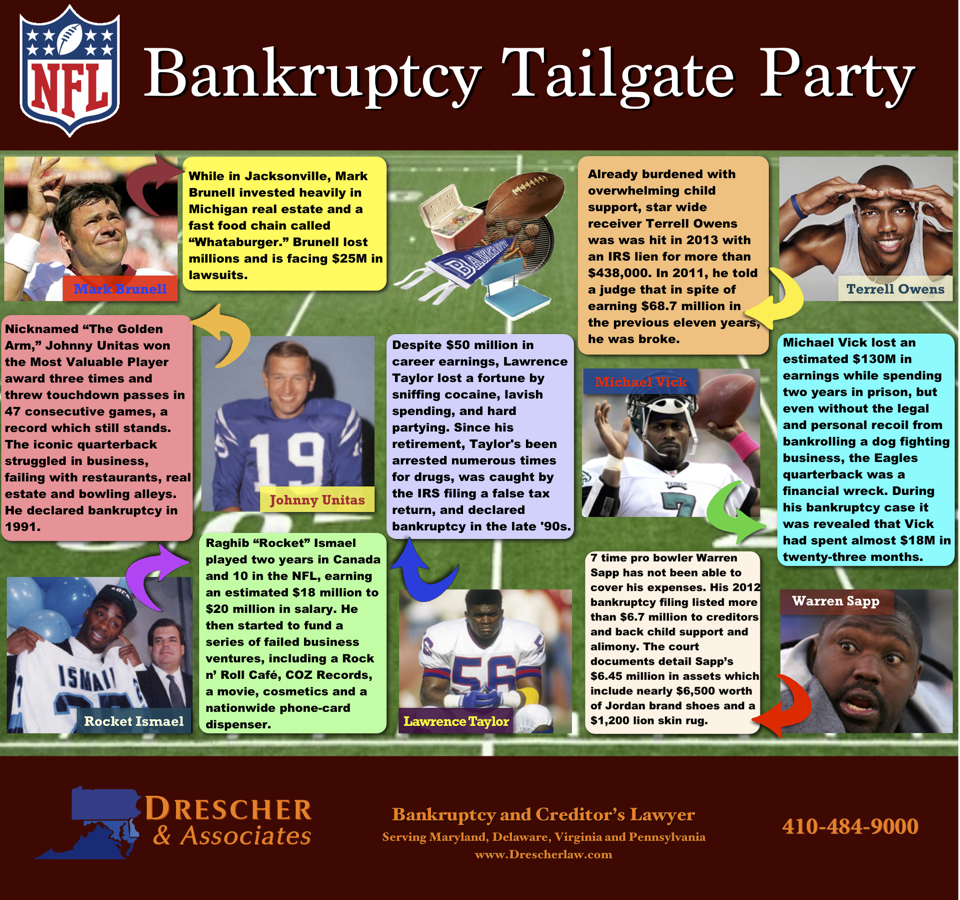

Despite thrilling us every weekend with their on-field skills, these NFL stars proved incapable of managing the millions of dollars they earned during their professional careers. Some simply invested their money in high-risk ventures that had little chance of success. Others were victims of their own “too much too fast” impulses. All of them found that easy cash and easy credit don’t always add up to a successful financial life.

The post NFL Bankruptcy Tailgate Party appeared first on Baltimore Bankruptcy Lawyer.

]]>

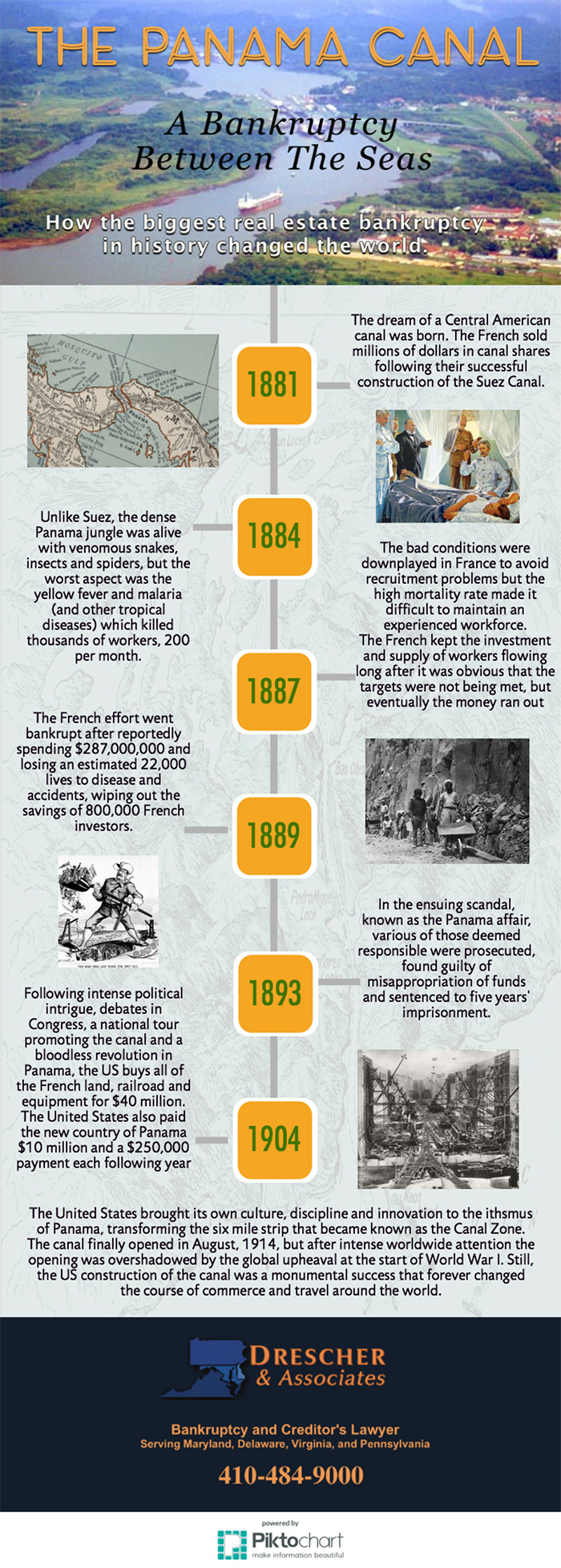

The post The Panama Canal – A Bankruptcy Between The Seas appeared first on Baltimore Bankruptcy Lawyer.

]]>