The post Bankruptcy Repeat Filings: A Busy 2013? appeared first on Baltimore Bankruptcy Lawyer.

]]>

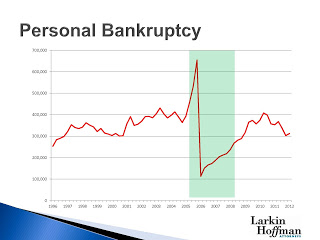

When George W. Bush signed the Bankruptcy Abuse Prevention and Consumer Protection Act (“BAPCPA”) into law in April, 2005 panic beset the bankruptcy community. Many bankruptcy lawyers feared that BAPCPA would severely limit the rights of debtors under the Bankruptcy Code. Even worse, nobody knew what impact many of BAPCPA’s new restrictive features would have on debtors in the real world.

As a result of this panic, between October 1 and October 17, 2005 bankruptcy lawyers filed more than 600,000 cases for their clients under Chapters 7 and 13. There has never been a busier time for filing bankruptcy cases in US history. In contrast, only about 20,000 Chapter 7 cases were filed in the following 10 weeks.

In recent years the national recession and the real estate crash have caused bankruptcy filings to rise to normal pre-BAPCPA levels. The news in the bankruptcy community however is that filings are poised to drop significantly from peak recession figures. According to this Boston Globe article, bankruptcies filed by individuals fell 13 percent in the first half of the year and are down nearly 20 percent over the past two years nationwide.

However, one of the BAPCPA changes may have a significant impact in 2013 filings, when the new waiting period between bankruptcy filings expires. Pre-BAPCPA debtors could obtain discharges in bankruptcy every 6 years. Under the new law, the waiting period for discharges in multiple Chapter 7 cases is expanded to 8 years, as described in this article.

Both pre- and post- BAPCPA the statistics on bankruptcy recidivism are more or less the same: just over 16% of filers will seek a second discharge in bankruptcy. This means that bankruptcy professionals should be ready for a mini-spike in bankruptcy filings after October 2013, when the bankruptcy world celebrates the eighth anniversary of BAPCPA becoming the law of the bankruptcy land.

The post Bankruptcy Repeat Filings: A Busy 2013? appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Chapter 13 Denial Of Payroll Deductions May Be Unconstitutional appeared first on Baltimore Bankruptcy Lawyer.

]]>The rationale behind these decisions (notwithstanding a fairly convoluted statutory construction) is understandable and even sympathetic: funding 401(k) payments during a repayment plan takes money out of creditors’ pockets and puts it into debtors’. Of course, this analysis ignores the reality that the 401(k) payment is an exclusion of a debtor’s pay that reduces their tax bill. Also, many employers match a portion of the 401(k) contribution, and this money is also lost to the debtor. Thus Uncle Sam and the debtors’ employers are enriched by the rule, with no equivalent benefit to creditors.

Especially troubling is the difference between Chapter 13 and Chapter 7. Debtors who qualify for Chapter 7 may take all the payroll deductions they want, even though creditors are enjoying no return to mitigate their losses. Chapter 13 debtors, however, are denied payroll deductions for the life of their repayment plan, between 3-5 years, even though creditors are receiving some compensation.

As courts grow more comfortable with BAPCPA the walls are closing in. Chapter 13 used to be thought of as a voluntary repayment mechanism, but with the “presumption of abuse” shutting the Chapter 7 door Chapter 13 becomes the only real choice for many debtors to get any bankruptcy relief. Congress and the Courts may insist that the choice is “Chapter 7 or no Chapter 7” but the truth is more like “Chapter 13 or no bankruptcy.”

As courts grow more comfortable with BAPCPA the walls are closing in. Chapter 13 used to be thought of as a voluntary repayment mechanism, but with the “presumption of abuse” shutting the Chapter 7 door Chapter 13 becomes the only real choice for many debtors to get any bankruptcy relief. Congress and the Courts may insist that the choice is “Chapter 7 or no Chapter 7” but the truth is more like “Chapter 13 or no bankruptcy.”

When debtors have no options, depriving them of 5 years of 401(k) deposits and income tax deductions while their Chapter 7 counterparts enjoy both makes no rational sense. When those who qualify for Chapter 7 can make payroll contributions yet those who don’t cannot, a classification scheme is created that imposes real hardship.

In other words, can BAPCPA survive an equal protection challenge?

The post Chapter 13 Denial Of Payroll Deductions May Be Unconstitutional appeared first on Baltimore Bankruptcy Lawyer.

]]>The post A Jail Cell For A Debtor Who Went Too Far appeared first on Baltimore Bankruptcy Lawyer.

]]>Recently a North Carolina bankruptcy court helped a lender strike back against a debtor who had played every trick in the book to avoid a commercial foreclosure, and then found a few tricks not in the book. As detailed in this Forbes article, Nick Stratas said he wouldn’t interfere with his bank’s foreclosure sale and then did interfere. His claim? The auctioneer mumbled too much during the sale, so Stratas couldn’t compete with his lender by making phony bids to drive up the price of the sale.

Perhaps before BAPCPA the bankruptcy judge would have slapped him on the wrist with harsh words and a reprimand, but not now: the judge threw Stratas in jail until the lender could complete the sale and Nick paid the bank $10,000 for their trouble.

This judge got it right. Honest debtors are entitled to a fresh start and protection from their creditors. That’s what the bankruptcy laws are all about. They’re not to provide a playground for con artists trying to wing their way through on court delays and legal technicalities.

The post A Jail Cell For A Debtor Who Went Too Far appeared first on Baltimore Bankruptcy Lawyer.

]]>The post Elizabeth Warren and the Transparent Debtor appeared first on Baltimore Bankruptcy Lawyer.

]]>

(Note: much of the facts in this blog are quoted from the Wikipedia article on Elizabeth Warren)

I have long admired, and will probably always admire, Elizabeth Warren. Since before my career began in 1985 as an aspiring bankruptcy lawyer (I was in law school then, to graduate in 1986) Elizabeth Warren has been a strong supporter of consumers’ rights. Hers has always been one of the most prominent voices in support of families in our country. Ms. Warren is a professor of bankruptcy law at Harvard, certainly a deep well of legal pedigree in our country (don’t believe me? Watch the Pilot for the USA original series “Suits“: Top NY law firm Pearson Harden only hires out of Harvard Law School). Beginning in the late 1990’s Ms. Warren leapt to national prominence with her strong opposition to the changes the credit card cartel sought to impose on the U.S. bankruptcy laws through BAPCPA (Bankruptcy Abuse Prevention and Consumer Protection Act). She and the rest of the commission appointed by Congress to review the proposed changes all agreed that BAPCPA is an abomination, but never mind: in 2005 at the beginning of GW Bush’s second term in office, BAPCPA became the law of the land.

Not long after BAPCPA became law our national economy began to suffer the meltdown we all know too well: crashing stock market prices, bottomless real estate values, rampant corporate layoffs. Elizabeth Warren stepped up and is running for office to become the US Senator for Massachusetts. She is involved in a hotly contested fight for the seat against Republican incumbent Scott Brown. She ran unopposed in the Democratic primary, receiving a record 95.77% of the delegates. Everything is set for Elizabeth Warren to speak truth to power on Capitol Hill, but now she has hit a roadblock.

Apparently Warren identified herself as a minority in a directory of law professors from 1986 to 1995, specifically a native american. She claims that “she had heard family stories about her Cherokee ancestors her entire life.” Indeed, according to Michael Dean of the Oklahoma Historical Society, as intermarriage had been common in the 1890s in Oklahoma (Warren’s home), many individuals refer to having some Native American ancestry. Unfortunately, the Boston Globe reported on May 25 of this year that “both Harvard’s guidelines and federal regulations for the statistics lay out a specific definition of Native American that Warren does not meet.” Even a Cherokee group has protested.

This controversy is a shame, as it drowns out the really important national discussion on how to help families and our economy. However, if the charges are true, Professor Warren should know better. Honesty is the lynchpin of our consumer bankruptcy system. Schedules of assets, debts, income and expenses are largely presented on the honor system: the bankruptcy process would become hopelessly clogged if each debtor’s sworn financial statements had to be independently verified. The penalty for lying on your schedules is denial of discharge, as explained in this video. This is true whether or not the omission is material. In every court in the country, bankruptcy judges will rule without fail that a discharge in bankruptcy is reserved for only honest debtors.

So it is with our political representatives. As a bankruptcy professor, Elizabeth Warren knows better than most the premium of honesty required to obtain the enormous privilege of a political office or a discharge of debts in bankruptcy.

The post Elizabeth Warren and the Transparent Debtor appeared first on Baltimore Bankruptcy Lawyer.

]]>